ProSight Credit Risk Navigator

Power up your risk mitigation and credit performance analysis.

Understanding How Your Portfolio Stacks Up Against Other Banks Can Help You Adjust Your Strategy.

Measuring your commercial loan performance is necessary during any part of the economic cycle and even more critical during periods of stress.

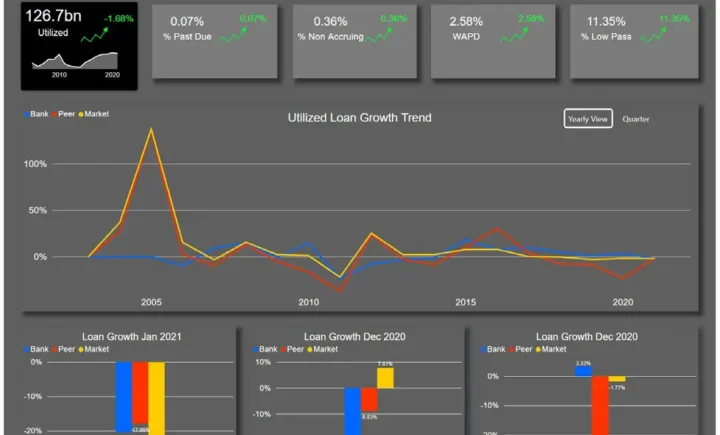

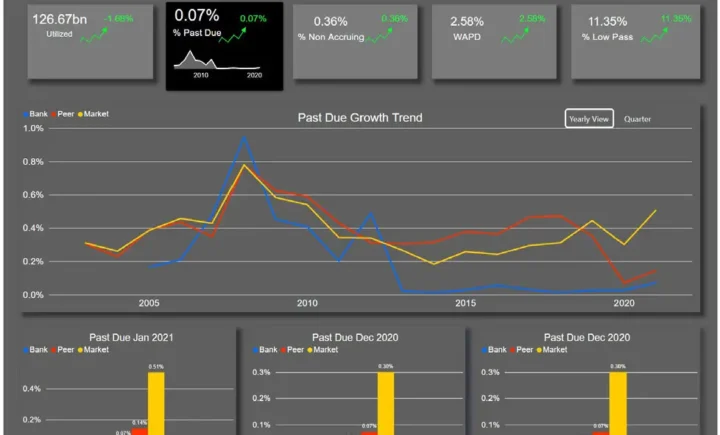

With ProSight Credit Risk Navigator, powered by AFS, you can access years of credit data in a modern, easy-to-use, filterable dashboard. Maximize the key benefits of the industry’s next generation commercial credit risk database to stay ahead of the curve.

Monthly Trends & Content

Expertly curated data and analysis delivered through bulletins, webinars, and blogs on a regular basis.

Ability to Easily Segment

Data can be viewed by size, geography, loan type, and many other segments to easily compare credit performance.

Robust Database

850,000 individual loans totaling $1T in committed exposure across C&I and CRE sectors.

New platform powered by Microsoft BI:

Featuring Microsoft Power BI, get the most from the ProSight Credit Risk Navigator database at your fingertips.

Powered by the extensive ProSight Credit Risk Navigator database, your credit portfolio assessment has become easier and faster. Discover our tailored solutions now available for banks of all sizes.

Top Core Metrics & Measurement Categories:

- Rating Loss

- Balance Growth

- Expected Loss

- Nonaccruals

- Delinquencies

- Percent Criticized

- Industry

- Geography

Commercial Credit Quality Bulletins

Helping leaders act with confidence

Together as ProSight, BAI and RMA offer industry-leading peer sharing & collaboration, thought leadership, learning & development, and decision support solutions.